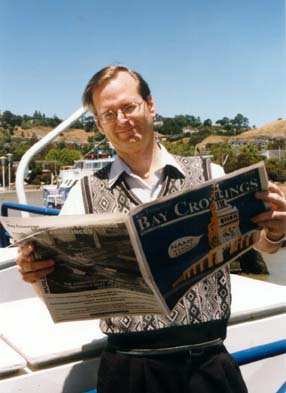

Everyone talks about the Bay Area traffic mess but not many people actually seem to do much about it. Someone that has been doing something, and for many years at that, is John Eells. Few people have as broad an understanding of the Bay Area traffic problem. We recently sat down with John and asked him to make it understandable for us.

Published: September, 2000

Everyone talks about the Bay Area traffic mess but not many people actually seem to do much about it. Someone that has been doing something, and for many years at that, is John Eells. Few people have as broad an understanding of the Bay Area traffic problem. We recently sat down with John and asked him to make it understandable for us.

John earned his Bachelors Degree in Architecture and also a Masters Degree in City Planning from U.C. Berkeley. He has worked with the Legislative Analyst’s Office at the California State Legislature, Cal Trans on the Sacramento Light Rail Transit Project and spent seven years in the role of Transportation Planning Coordinator for Marin County. John has been a transportation-planning consultant for the past 8 years.

Why the opposition to the Water Transit Authority?

I think there are several reasons. First of all, MTC and several counties, cities and transit districts throughout the Bay Area believe that ferries should not receive special treatment over other transportation improvements and transportation services like highways and rail and bus systems. There is also a major concern among existing transit districts that they might have to compete with new ferries and that could result in them ending up with less money than they have now.

MTC is focusing on where they think most of the growth in commuting over the next twenty years is going to occur. Since most of the growth in traffic that MTC is projecting does not cross the Bay, ferries are not a high priority for MTC.

Earlier this year, MTC announced that ferries require a public subsidy of some $50 per passenger. Now just a few months later, they’ve revised those numbers all the way up to $450 per passenger. Actually, it’s up to $650.

Can we trust these numbers, or is MTC simply cooking the books to make ferries look bad?

Well, first of all, I don’t think the numbers are comparable. I think we are dealing with apples and oranges here. I’m not exactly sure what MTC is referring to with the $50 per passenger, but it’s probably their estimate of the total cost per passenger with all passengers included in the calculation. So, if you just figure out what it costs to carry all these people across the Bay, divide by the number of people on the boat, you have the cost per passenger.

That is not what the estimates of $100 to $650 were all about at all. Those are the estimated costs for each new transit rider on the ferries. This is an important distinction. In this MTC calculation for the cost per new transit rider, they’re not including any ferry riders who have switched from buses and trains over to ferries. They’re only looking at the new riders who weren’t previously riding transit at all. Say for example, you have a thousand riders. Let’s say 900 of them transferred from other transit services and only 100 are new. So, the cost per new rider is based on the 100, not the 1,000.

I think this a very important issue because MTC is assuming that the vast majority of the ferry riders would not be new transit riders at all, but rather transfers: people who are switching from buses and trains over to ferries. So, they’re projecting a very small number of new riders. That’s why you get those high cost numbers because you’re dividing the total cost only by new riders, not by total riders. I don’t know if that’s clear, but it’s a very important distinction because I believe that when we implement major ferry services throughout the Bay Area, the number of new riders will be much greater than what MTC is anticipating. Therefore, the cost per new riders will be much less because there will be far more new riders. On most of the ferry services that the Water Transit task force is recommending, MTC is projects only fifty new riders per day, a very small number. I don’t agree with that at all.

This kind of ridership estimation is more of an art than a science. There are many assumptions you have to make as well as many judgment calls. MTC is making the assumption that ferries are not going to be that attractive to automobile users. Basically, they see ferries as an alternative to riding BART into the city or taking a bus across the bridges. MTC feels you’re going to get most of your ferry riders from buses and trains. I don’t think that that’s necessarily the case at all. Now there’s no perfect crystal ball. Nobody really knows. But MTC has made a whole series of technical assumptions that are debatable in my opinion.

How bad is the overall bay transportation mess? What would it take to fix it once and for all?

Well, first of all, I think it’s very bad and likely to get a lot worse. And I don’t think that we can build our way out of the transportation mess here in the Bay Area. I think one way to kind of illustrate this, to get a sense of what we’re really talking about here and the magnitude of the problem and the magnitude of the challenge, is to look at a study the California Transportation Commission (CTC) recently did of transportation needs throughout the state over the next ten years. Now these are projects that they felt were necessary just to keep things from getting worse, to maintain the level of congestion that we’ve already got, not improve matters in any significant way. The CTC recently came up with an estimate — and I’ve looked at the details and I think it’s pretty credible estimate — of $120 billion being needed over the next ten years just to keep traffic from getting worse. That’s $12 billion a year every year for the next decade.

Not to improve things, just to keep them from getting worse?

Yes, basically, just to maintain the system we have now and to keep things from getting worse as the population of the State continues to grow. This $120 billion totally dwarfs the amount of money that we can get our hands through existing funding sources. Of course, the $5 billion recently approved by the Governor and the Legislature for the next five years is obviously an important first step. But compared to $120 billion, it is almost microscopic at five percent of the estimated total need. So, I think we have to go beyond just looking at the money and just looking at how many new highways we can build and how many new transit systems we can implement. We’re going to need to do much more and in particular, we’re going to need to look at ways to reduce the demand on the system. We’re just not going to be able to respond to that growing demand if the state adds another 20 million people. That’s going to overwhelm the system. So we’re going to have to change our behavior.

We need to do a lot more telecommuting. And the good news is the technology to allow that to happen is right here today. We just need to change some of our attitudes and some of our ways of using the available technology.

I’ll give you an example of what I mean. If you took all the people who are currently commuting to work each day and you said one-fifth of those people are going to stay at home and work at home one day a week so that it balances out evenly, then on any given day there would be 20% fewer people actually commuting to work. If you did that in the Bay Area tomorrow, you would largely eliminate traffic congestion. To accomplish the same result building new highways and transit facilities would cost billions. So you’ve got two variables, supply and demand, and if we try to respond to the problem by only increasing the supply, you’re going to need billions and billions of dollars. On the other hand, you can get a lot of results by reducing demand. But we haven’t done very much of that yet.

Another area we need to focus a lot more attention on is land use, particularly housing. One of the things that’s really driving much of the whole traffic problem in the Bay Area — and will drive it even more in the future — is the cost of housing. As that cost of housing throughout the Bay Area skyrockets, it’s inevitable that we’re going to have worse and worse traffic congestion. I think we’re basically going to divide the Bay Area into two parts. One part will be the Bay Area where many of us work and the other part will be the Bay Area where many of us live. For many of us those two Bay Areas will be completely different areas. The place where many of our new residents will be living is not really what we think of as the Bay Area at all. What we’re really talking about here is massive growth in places like Fairfield, Vacaville, Davis, Sacramento, Stockton, Modesto, Morgan Hill, Gilroy and even Fresno. They’re all going to be become a part of the Bay Area in terms of where people actually live to commute to our jobs. If you have housing costing five to ten times as much in the Silicon Valley as it costs in Modesto, you can imagine where a lot of people are going to end up living. The prognosis is for a far greater number of people commuting from the Central Valley into the Bay Area. We’re going to have not tens of thousands but hundreds of thousands of people commuting into the Bay Area in the next twenty years if things don’t change in the area of housing. I think with that in mind it’s pretty clear if we’re going to solve our traffic problem, we’re going to have to pay a lot of attention to housing. In fact, we’re probably never going to really solve our traffic problem unless we make some real progress with affordable housing. By that I mean work force housing in the Bay Area that’s close to transit so that everyone doesn’t have to commute in from the Central Valley in his or her car.

What’s the scoop on this SCA-3? Wasn’t that designed to improve transportation?

Absolutely. Senate Constitutional Amendment #3 which was sponsored by Senator Burton, the leader of the State Senate, was designed to make it easier to pass local sales taxes for transportation. Unfortunately, it’s dead for this year. But the Senator is firmly committed to trying to get it on the ballot sometime in 2002. He was targeting November of this year. It requires a statewide vote because it’s a constitutional amendment. That’s not going to happen this year because the Senator couldn’t work it out with the Republicans in the Assembly.

I think it’s really important to step back and understand what the basic purpose of SCA-3 is and why it is so essential for the entire state, not just the Bay Area. The basic purpose of SCA-3 is to provide some relief for the two-thirds vote requirement for local sales taxes for transportation in California. We now have what we call existing self-help sales tax counties. There are eighteen self-help counties in the state that have passed half-cent sales taxes for transportation.

The thing to recognize here is that every one of these self-help sales taxes, all eighteen, will be expiring by the year 2011. They’re all for a limited time period, ten years, fifteen years, twenty years. They’re all going to be gone if they don’t get renewed. At this current time, they need a two-thirds vote to get renewed. Now, very few of them got a two-thirds vote when they originally got passed. So, the question obviously is, how did they pass without a two-thirds vote? Well, they were all passed before the State Supreme Court decided that Prop. 13 applied to these particular local sales taxes for transportation. There had been what some people consider a loophole in the law that allowed these taxes to be passed with a simple majority. But the Supreme Court closed that loophole in 1996 and now every one of them faces a two-thirds vote requirement to get renewed.

You know, people tend to think that we just spend state money and federal money implementing highway improvements and transit improvements. But in reality, in California, we spend a great deal of local money on these improvements. Approximately half of the money we have available in California for local transportation improvements that expand capacity to help reduce traffic congestion are coming from these eighteen self-help sales taxes. So the local money is extremely important. It’s no longer just a question of going to Washington to get money for our highways and our transit systems. We’re funding much of that locally now. We’ve done it with these eighteen self-help taxes and they’re all going to expire if they’re not renewed. And if they do expire, I think the overall impact would be nothing short of catastrophic. So it’s absolutely crucial that Californians support Senator Burton’s SCA-3.

Why sales taxes to subsidize public transportation? Wouldn’t gas taxes make more sense and also be fairer?

I do believe that gas taxes would be fairer, more equitable and a more desirable way to fund transportation improvements for a number of reasons.

First of all, I think it’s clear that a gas tax really isn’t a tax at all — it’s a user fee. You know, when you drive on the streets and roads there’s a cost that has to be paid for, to build those highways, to maintain those highways and you’re helping to pay for that or should be helping to pay for that with your gas tax. So, yes, a gas tax is much more directly connected to transportation than a sales tax. Clearly, a sales tax isn’t connected to transportation at all. It’s just a general tax on all goods and services. However, there are some practical reasons why we haven’t really been pursuing gas taxes. Basically since the sales tax applies to most goods and services (except for food), it’s a broad tax with a huge tax base. So you don’t need a high tax rate to generate significant revenue. On the other hand, a gas tax is a very narrowly focused tax and you’re only taxing gasoline and diesel fuel. Therefore the tax base you’re working with is a very narrow and relatively small. So the revenue generating potential from the gas tax is much smaller. One way to think of it is a 15-cent gas tax generates roughly the same revenue as a half-cent sales tax. And that sounds a lot more appealing, doesn’t it, to people to pay a half-cent sales tax versus a 15-cent gas tax, particularly in this day and age when the price of gasoline has been skyrocketing.

Getting back to what I was mentioning before with the self-help sales tax counties, all eighteen — representing 80% of the state’s population — have local sales taxes for transportation yet not a single one of the 58 counties in California has ever succeeded in passing a local gas tax. We are simply unable to get two-thirds of the local voters to vote for a gas tax increase. It may be fairer, it may be more equitable, it may be more desirable, but we’re unable to get it done at the local level.

Now, it can be done at the state level. They have the authority to raise the gas tax. The Governor and the Legislature together can do it. It doesn’t even require a vote of the public, but keeping in mind that they’re elected officials and they’re very sensitive to the reception that they’re going to get from the public if they raise taxes without a vote. So the bottom line is even though they have the authority to do it, they’re pretty much unwilling to do it without a vote.

There are some big transportation improvement projects currently under way in the Bay Area, notably the BART extension to the San Francisco Airport. And there’s also talk about extending BART to San Jose. What do you think about these initiatives?

Well, I do not believe that BART to San Jose would be a wise investment. The $4 billion price tag for BART to San Jose is absolutely staggering in the context of the available money that we have to work with. What I call the opportunity cost of BART to San Jose is almost unimaginable. Do we spend $4 billion on BART to San Jose or do we spend it on vast improvements in commuter rail services and light rail services throughout the Bay Area, huge increases in bus services, and major increases in ferry services? All of these improved transit services would be far cheaper than BART to San Jose.

If you compare the benefits of BART to San Jose with the benefits of doing all of those other things throughout the region with that same $4 billion, I believe the benefits of greatly increasing rail services throughout the Bay Area, greatly increasing ferry services, and greatly increasing buses throughout the Bay Area, would far outweigh whatever narrow benefit you get from BART to San Jose which would only serve a relatively small number of people.

Well, overall, are Bay Area transportation dollars being wisely spent? Do some areas get more than they should? Do others get less than they should?

Well, I think that there are some inequities and problems in that respect. I think some areas do get more than they should and some areas do get less. But I don’t see that as the big issue and the big problem that we should be focused on. I think we need to step back and take a broader view of the overall question of how we should be spending our money. I think we really don’t have a consensus of what we’re actually trying to accomplish. I think that’s the level of dialogue and discussions we need to have. What are we even trying to do with all of the hundreds of millions or even billions of dollars we hope to get our hands on? If you look at the Bay Area as a whole, if you look at the elected officials, and the average resident of the Bay Area, there is no common vision of what we would like the region to look like in twenty to thirty years. And there are several different ways this could go. We don’t have a clear sense of where we’re trying to go.

I’ll give you a couple of examples. Do we envision the Bay Area becoming a compact transit oriented region in the next twenty years? Or are we OK with a low-density sprawling metropolis that extends all the way to Sacramento, Stockton, Modesto and Salinas? Which of those very different visions are we really pursuing? When we spend money on transportation improvements, are we actually trying to reduce traffic congestion for people who are choosing to drive alone? Is that our goal? Make it easier for people to drive alone? Or are we trying to provide attractive alternatives to driving alone, including transit, bicycling and walking?

I think it’s important to step back and recognize it makes a big difference which of these basic goals we’re trying to achieve. For example, if you’re trying to reduce traffic delays for all those people driving alone, if that’s our real goal, we’ll probably end up building a lot more highways. On the other hand, if we’re trying to provide an attractive alternative to driving alone, then obviously we should be focusing in a different direction, particularly improving transit services throughout the Bay Area, making it easier to bike and walk throughout the Bay Area and locating new compact development around transit to curb suburban sprawl throughout the countryside surrounding the Bay Area.

One of the things people need to understand is that low-density suburban sprawl is very difficult to serve with transit. So if our goal is to have more people ride transit instead of driving alone, then suburban sprawl is acting against our goal every step of the way.

Are increased bridge tolls inevitable? What about charging higher tolls at rush hour?

Yes, I do think that increased bridge tolls are inevitable and I don’t think that’s a bad thing at all. In fact, I think increasing bridge tolls would be the logical and rational thing to do. There’s a direct connection between increasing bridge tolls and improving ferry service. Modern ferry services were introduced to take some demand away from the bridges and extend the life of the bridges. When you look at what it costs to increase the capacity on the existing bridges or you look at what it costs to build whole new bridges, it’s astronomical. We’ve got to deal with the reality that our bridges are either full now or will be full shortly. We need to find ways of providing some relief for our bridges. Ferry routes can obviously be run parallel to the bridges as we currently do with the Larkspur ferry and the Sausalito ferry in the North Bay. It makes sense to use bridge tolls to operate ferries because those ferries are benefiting the bridge in a very real and tangible way. They’re reducing the daily demand on the bridge and that is something that the people driving on the bridge benefit from and logically should help pay for.

As far as charging higher tolls during certain rush hours, I think that also makes sense, on the same grounds. We need to spread out the demand on the bridges. We need to have people traveling at different times on the bridges rather than everyone trying to travel at the same time. So one way to do that obviously is to provide some incentive to people to spread out their travel patterns a little bit so they’re not all trying to go on the bridge at the same time. So, higher tolls during the higher peak travel period makes sense as a way to encourage people to travel at other times

You played a pretty significant role in the campaign that asked Marin and Sonoma voters to raise taxes for a commuter rail system among other things. It failed. Why?

The proposed half-cent sales tax was basically designed to provide $300 million dollars for transportation improvements over twenty years in Marin County to implement commuter rail service, complete the carpool lanes on Highway 101, dramatically improve bus service, and to implement more bike lines and more pedestrian facilities. It was a comprehensive, broad based local program. I think it was very good package.

So why did it lose?

Well I think there are several reasons. First of all, there’s obviously the general resistance to raising taxes and a lot of distrust of elected officials. Secondly, it gets back to what I was describing a little bit earlier about the lack of a clear vision for the future of the Bay Area. In Marin, there’s strong support for widening 101 between Petaluma and Novato, as well as very widespread opposition. Likewise, there’s a lot of support for implementing passenger rail service but there’s also very strong opposition. So, if you propose any of these major improvements — passenger rail service, 101 improvements, and things of that sort — you get a lot of support and you get a lot of opposition. You kind of divide the community right down the middle, which makes it difficult to raise taxes because you’ve probably got 25% of the people that are against taxes no matter what.

Any finally, in Marin, growth is always a big issue. Some people think that rail service, or improvement in the bus service, is going to bring more growth. Put that all together, it’s pretty difficult to get a tax passed, particularly when you need a 2/3 vote.

Now, let’s talk about the technique that we used to try to get around that two-thirds requirement, the A plus B approach. Under the A plus B approach, what you do is you have a general sales tax on the ballot, keeping in mind the Prop. 13 requirement for a two-thirds vote for special taxes does not apply to general taxes. It only applies to special taxes. It’s ironic because with a special tax you spell out exactly how you’re going to spend the money and you provide full accountability by listing the projects in a way that is binding so that the elected officials have to spend the money in accordance with the list of projects provided by the voters when they voted for the tax. But that requires a two-thirds vote. If you just want a general sales tax where the money could be spent for anything, all that needs is a simple majority.

So the logic is somewhat backwards in my mind. A lot people would like to know how the money is going to be spent and they like to decide that that’s how they think it should be spent. So when they’re voting for the tax, they’re also voting for the specific expenditures and they know that that money can only be spent on those projects that they think ought to be implemented. You don’t have that guarantee when you do a general tax. So we did a general tax because that only requires a simple majority. Then, we did an advisory measure, which outlined all the projects we thought could be paid for with this tax. And the voters did, in fact, agree with the plan. They approved it by 63%. And that is an overwhelming majority in Marin County about what to do about anything. So, basically, we got a victory on the advisory measure, but we only got 43% on the tax. And one of the reasons there was the lack of trust in elected officials.

Prop. 13 seems to come up again and again as a problem. Do you think knowing what they do now, California voters would pass Prop. 13 today?

Absolutely, I think it would pass overwhelmingly. And I say that with a lot of anxiety because I am very concerned about the two-thirds vote requirement for a number of reasons. First of all, I think it is crippling California financially. We have very little capability to implement the tremendous infrastructure that we are going to need if we need a two-thirds vote to get money. I also believe that the two-thirds vote requirement violates the one-person, one-vote provision of the U.S. Constitution.

One way to look at that is if I vote for a tax and you vote no, then you’re vote counts twice as much as mine. What that ends up doing is very important for the future of California because it allows the minority to dominate the majority.

Another analogy that I think works pretty well is an election between two candidates where you follow something similar to a Prop. 13 rule. Let’s say you have one candidate get 65% and the other candidate gets 35%, which one wins the election? The candidate with 35% wins the election. That’s an analogy for candidates. It’s what we actually deal with when it comes to taxes: if you have 65% supporting a tax, which is an overwhelming majority, and only 35% against the tax, then the tax loses. So, I have a lot of trouble with that. Having said that though, I still think that the public would support Prop. 13. It’s a huge problem for California because when you look at our schools, when you look at our highways, when you look at our transit, we’re near the bottom in just about everything in terms of per capita spending. Prop. 13 has a lot to do with that because it has been too difficult to raise taxes at the local level since Prop. 13 imposed the two-thirds vote requirement.